Basel III’s Liquidity Risk Measures: NSFR and LCR

The Basel III reforms introduced two crucial liquidity risk measures: the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). These measures were designed to promote short-term and long-term resilience of the financial sector to liquidity shocks. Liquidity risk is the possibility that a financial institution cannot meet its short-term debt obligations. This risk refers to the potential difficulty that a financial institution may face in meeting its short-term financial obligations due to an inability to convert assets into cash without incurring a substantial loss. Liquidity risk arises from various scenarios, including market changes, unforeseen expenses or withdrawals, or a sudden uptick in liabilities. It arises when there is a mismatch between assets and liabilities, making it difficult to sell assets quickly at market value to meet short-term obligations. If not managed properly, this risk can lead to significant financial losses, cash flow problems, and reputational damage, which can worsen the situation. Effective liquidity risk management is crucial to ensure financial stability, and a proactive approach includes adhering to regulatory standards that enforce strict liquidity requirements.

The Basel Accords represent a series of international regulatory frameworks developed to ensure that banks operate with sufficient cash on hand to meet their short-term needs and obligations. These accords, created by the Basel Committee on Banking Supervision (BCBS), are vital to the stability of the global banking system. As the banking industry is heavily regulated by law, compliance with these standards is mandatory to improve the banking sector’s ability to absorb shocks arising from financial and economic stress. Basel serves as the foundation for prudent risk management, guiding banks in ensuring financial stability and protecting depositor interests, reflecting a global emphasis on robust liquidity risk management. Failure to adhere to Basel regulations can result in severe consequences, including the loss of a banking license.

Basel framework is structured around three pillars, each addressing different aspects of banking regulation and risk management. Pillar 1 focuses on minimum capital requirements, ensuring that banks hold enough capital against their risk-weighted assets (RWA). Pillar 2 deals with the supervisory review process, providing guidelines for regulators to assess and ensure that banks have adequate capital beyond the minimum requirements to cover all material risks. Pillar 3 emphasizes market discipline through enhanced disclosure requirements, ensuring that banks are transparent about their risk profiles, capital adequacy, and risk management practices.

Pillar 2 is crucial for a bank's liquidity because it allows regulators to tailor capital requirements to the specific risks of each bank. While Pillar 1 mandates a minimum capital requirement of 8% of RWA, Pillar 2 recognizes that this may not be sufficient for all banks. Suppose the supervisory review determines that a bank’s risks are higher than what is covered under Pillar 1. In that case, the regulator can require the bank to hold additional capital, especially after SREP and LSREP with regards to ICAAP and ILAAP. This increase can be significant, potentially raising the total capital requirement to 12% of RWA or more, depending on the bank’s risk profile, outside the 3 buffers previously mentioned (CCB, CCyB, and Systemic Risk Buffer). Pillar 2 ensures that banks are adequately capitalized to cover all material risks, thereby promoting financial stability.

For Liquidity Risk, key risk metrics of Basel III’s Pillar 2 ILAAP exercise are the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). The LCR requires banks to hold High-Quality Liquid Assets (HQLA) that can be readily converted to cash to meet their net cash outflows over a 30-day stress-test scenario (e.g. Bank Run). One stark illustration of the stress-test scenario is the phenomenon of bank runs, which occur when a large number of depositors withdraw their funds simultaneously due to fears of the bank’s insolvency. The NSFR requires banks to maintain a stable funding profile with respect to the composition of their assets and off-balance sheet operations, promoting long-term resilience against liquidity risk.

Liquidity Coverage Ratio (LCR)

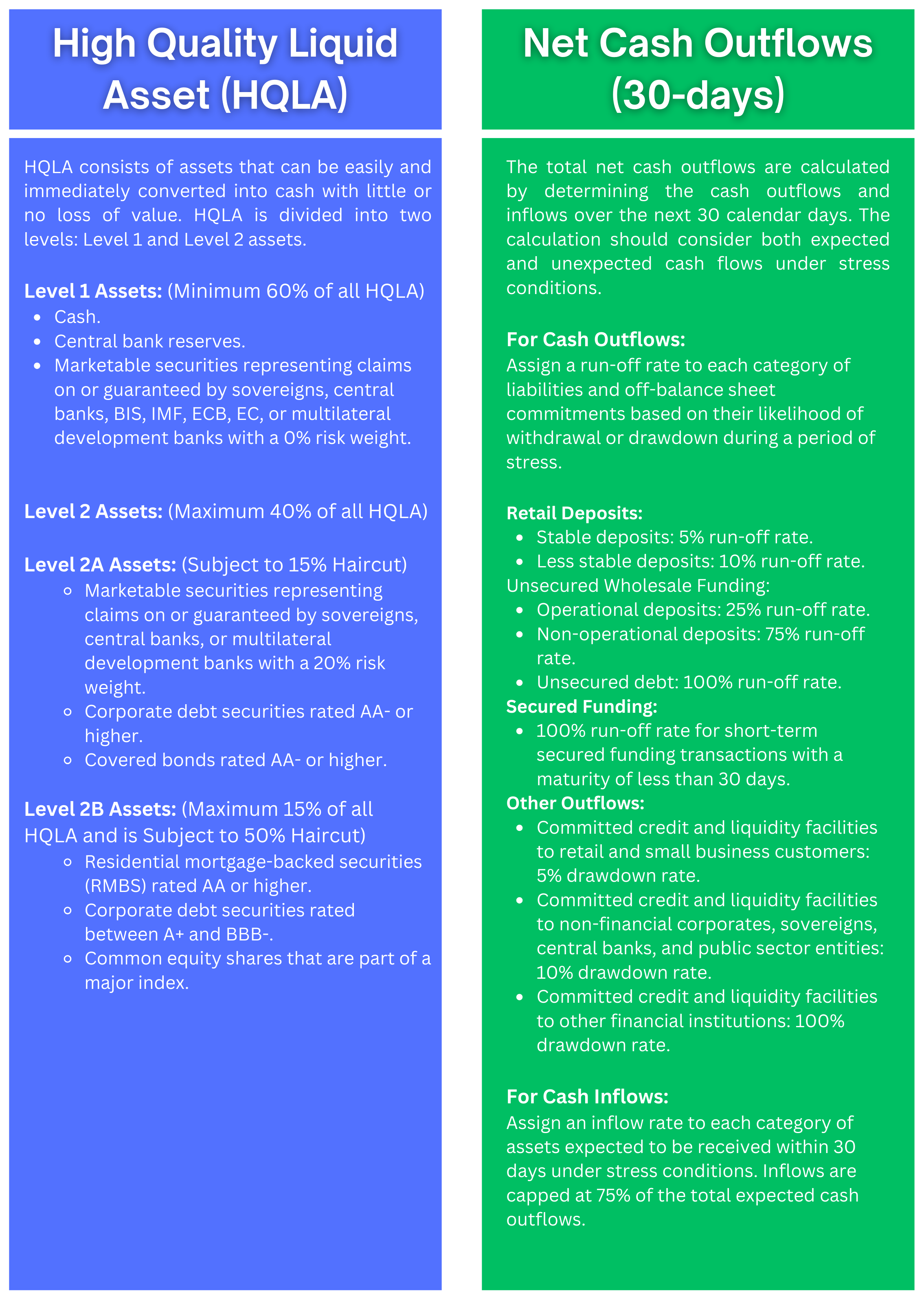

The Liquidity Coverage Ratio (LCR) is another key risk metric under Basel III, aimed at ensuring that a bank maintains an adequate level of high-quality liquid assets (HQLA) to survive a significant stress scenario lasting for 30 days. Information of High-Quality Liquid Assets (HQLA) and total net cash outflows and inflows over the next 30 calendar days, are required, in which should consider both expected and unexpected cash flows under stress conditions as its denominator. To show bank's resiliency on liquidity risk, LCR value must also be at least 100%.

The LCR requires banks to hold enough High-Quality Liquid Assets (HQLA) to survive a 30-day liquidity stress scenario. The ratio is calculated as:

LCR = (Stock of HQLA) / (Total Net Cash Outflows over next 30 days)

Net Stable Funding Ratio (NSFR)

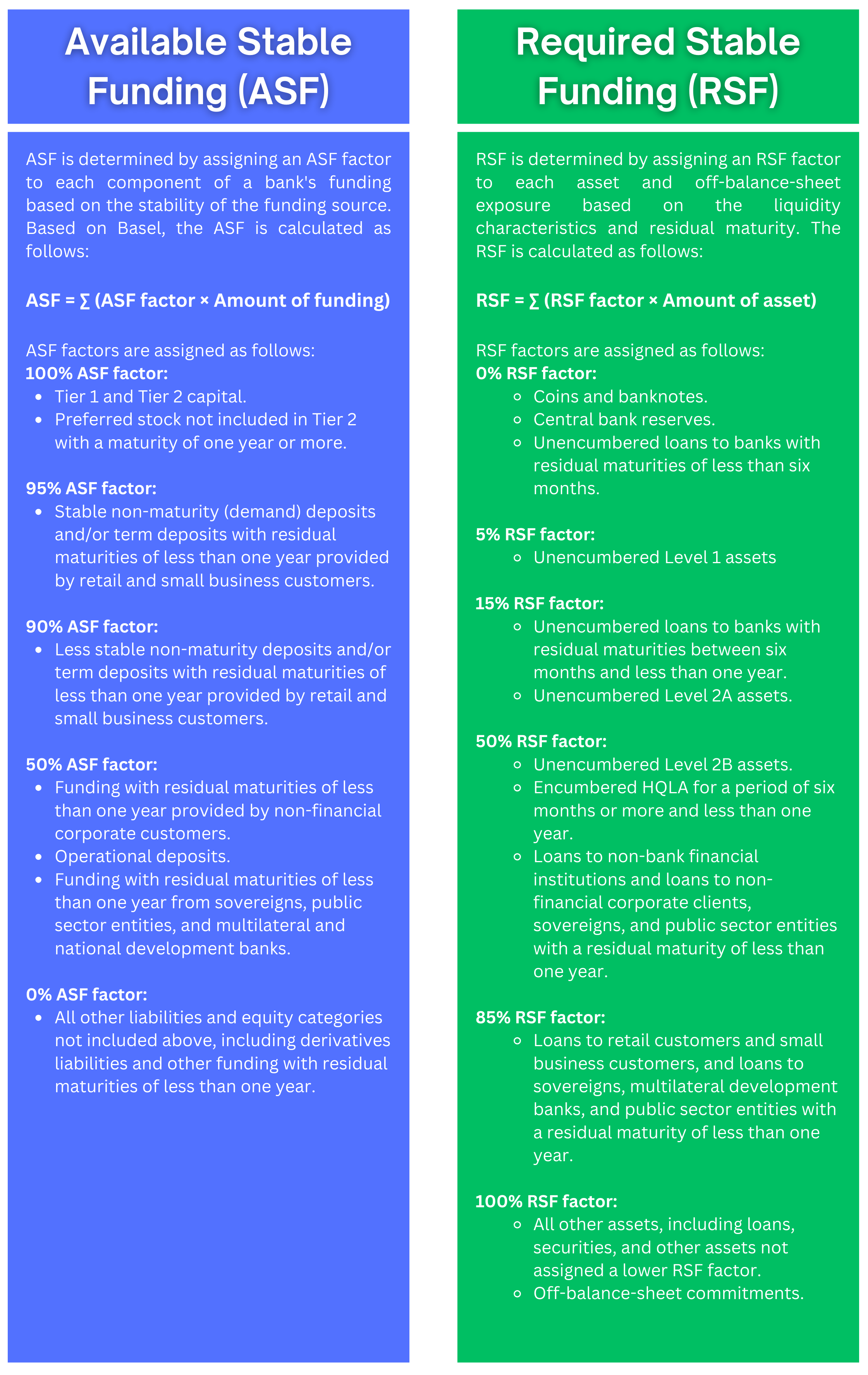

The Net Stable Funding Ratio (NSFR) is a key risk metric under Basel III designed to promote a more resilient banking sector by requiring banks to maintain a stable funding profile in relation to the composition of their assets and off-balance-sheet activities. It is calculated as the ratio of a bank's available stable funding (ASF) to its required stable funding (RSF) over a one-year time horizon. To show bank's resiliency on liquidity risk, NSFR value must be at least 100%.

The NSFR ensures that banks have a stable funding profile relative to the composition of their assets and off-balance sheet activities. The ratio is calculated as:

NSFR = (Available Stable Funding) / (Required Stable Funding)

Closing Statements

Calculating the values for NSFR (Net Stable Funding Ratio) and LCR (Liquidity Coverage Ratio) is relatively easy, but automating the process can be quite complex. Typically, these calculations are performed using an intraday reporting form that contains all the necessary variables, often scattered across multiple systems. While Microsoft Office is a popular tool for calculations due to its flexibility and ease of use, automation is impossible due to the abundant data. The latest cross-platform technology can cope with such tasks in a way that the data can be much more structured, and alignment between inputs from various systems can be done. Eventually, data flow would be traceable end-to-end, ensuring data lineage as required by BCBS 239.

In this exercise, our team in Vryska has developed a web framework solution as a compelling alternative, combining flexibility and automation for scalability. Here's an example of our NSFR and LCR solution that takes intraday reporting data from a CSV file, calculates the LCR value, and stores this value in a table for future reference.